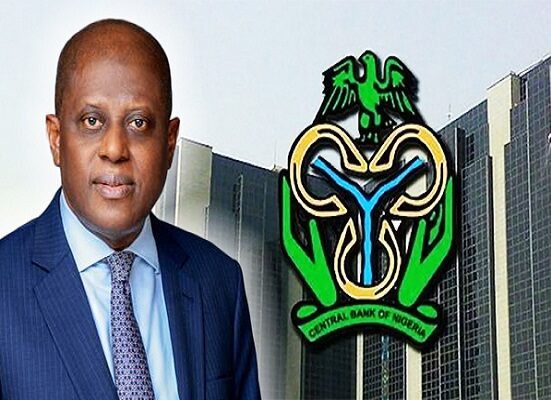

The Central Bank of Nigeria has delisted all Bureau De Change operators that failed to meet its new licensing requirements, effectively ending their operations. The bank confirmed the decision in a frequently asked questions document on Tuesday, following the expiration of compliance deadlines.

The CBN introduced revised guidelines for BDCs in February 2024, mandating higher capital requirements. Tier-1 operators are required to maintain a minimum capital of N2 billion, while Tier-2 operators must meet N500 million.

The apex bank initially allowed a six-month compliance window from June to December 2024, which was later extended by another six months, ending on 3 June 2025. Any legacy BDC that failed to meet the requirements by 30 November 2025 has ceased to exist as a licensed operator.

Also Read: Osimhen Wins GQ Sportsman of the Year in Turkey

The CBN said the measures are part of broader efforts to improve transparency, compliance, and stability within Nigeria’s foreign exchange market. Applications from new operators who meet the criteria will continue to be considered through the bank’s Licensing, Approval, and Requests Portal.

Leave feedback about this

You must be logged in to post a comment.