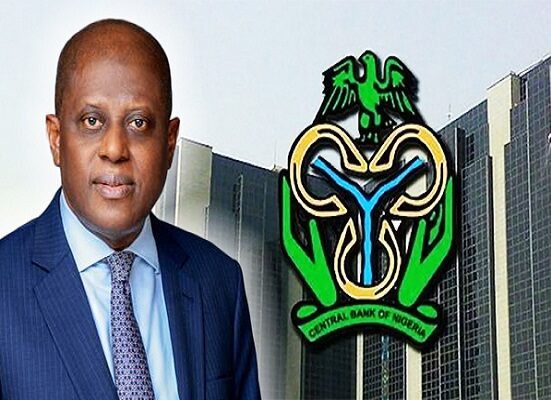

The Central Bank of Nigeria says regulatory bottlenecks, including unclear compliance requirements and delays in licence approvals, are hampering growth in Nigeria’s financial technology sector. The concerns are contained in the apex bank’s inaugural fintech policy insight report released on Monday.

The report followed a fintech policy forum convened by the CBN, which brought together regulators, industry leaders and experts. Insights were drawn from stakeholder surveys, a closed-door workshop in June 2025, the October 2025 CBN fintech roundtable and international benchmarking.

According to the CBN, industry players identified key challenges such as ambiguity in compliance obligations, inconsistent application of rules and weak coordination among regulatory agencies. The bank said these issues have increased compliance costs, created uncertainty and dampened innovation across the fintech ecosystem.

Also Read: Reps Advance Bill to Create Fintech Regulatory Commission(Opens in a new browser tab)

The CBN warned that if unresolved, the challenges could undermine innovation despite fintech’s growing role in financial inclusion and service delivery. It called for clearer regulations, stronger inter-agency coordination, improved supervision and sustained engagement with industry players to strengthen trust and maintain financial stability.

Leave feedback about this

You must be logged in to post a comment.