The Debt Management Office, DMO, has confirmed that its Series VII Sovereign Sukuk attracted an overwhelming ₦2.2 trillion in subscriptions—more than seven times the ₦300 billion initially offered.

The offering, which closed with a 735% oversubscription rate, signals robust investor appetite for ethical, non-interest financial instruments, particularly among pension funds, non-interest banks, fund managers, and retail investors.

With a seven-year tenor and a rental rate of 19.75%, the sukuk features biannual payments and a bullet repayment structure at maturity. Minimum subscription was set at ₦10,000, open to both institutional and individual investors.

Also Read: DMO to raise N300bn through Sovereign Sukuk for infrastructure projects

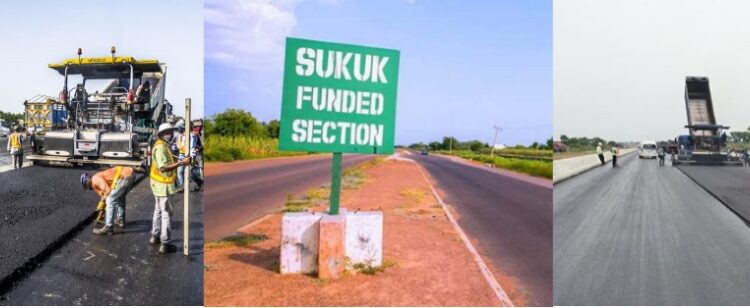

First introduced in 2017, Nigeria’s sovereign sukuk has become a key tool for domestic resource mobilisation and infrastructure financing.

Proceeds from this latest issuance will be channelled into constructing and rehabilitating critical roads and bridges across all six geopolitical zones and the Federal Capital Territory.

Leave feedback about this

You must be logged in to post a comment.