The Federal Inland Revenue Service says the National Identification Number issued by the National Identity Management Commission now automatically serves as a Tax Identification Number for individuals. The announcement comes amid public concerns over provisions in the new tax laws requiring a tax ID for certain financial transactions.

In a public awareness campaign posted on X, the FIRS said registered businesses will use their Corporate Affairs Commission registration numbers as their tax ID under the new system. It added that the Nigeria Tax Administration Act, due to take effect from January 2026, mandates the use of a tax ID, a requirement it said has existed since the Finance Act of 2019.

The FIRS said the unified tax ID system replaces multiple tax identification numbers previously issued by federal and state tax authorities. It said individuals do not need a physical card, as the tax ID is a unique number directly linked to their identity, adding that the system aims to simplify identification and reduce tax evasion.

Also Read: CAF Launches Annual African Nations League

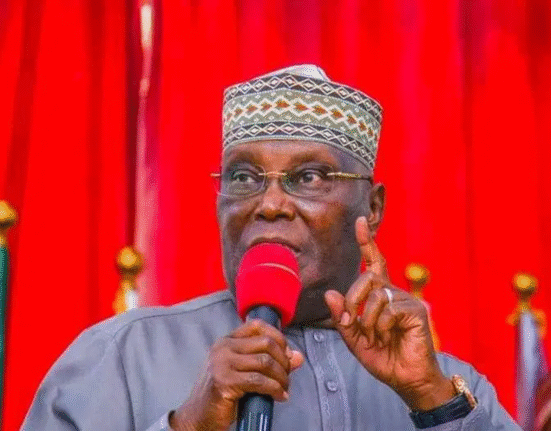

Meanwhile, the Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, has dismissed claims that all bank accounts must have a tax ID before January 2026. He said only individuals and entities earning taxable income are required to obtain a tax ID, adding that students, dependents and others without income are exempt, while most business and corporate accounts already have tax identification numbers.

Leave feedback about this

You must be logged in to post a comment.